MA Stock Price Mastercard Inc Stock Quote U.S.: NYSE

Contents:

Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page then you do so entirely on your own risk. The highest price target came in at $482 while the most pessimistic forecast predicted a rise to $380. According to Brett Horn, senior equity analyst at Morningstar, Mastercard stands to benefit from the ongoing shift toward electronic payments.

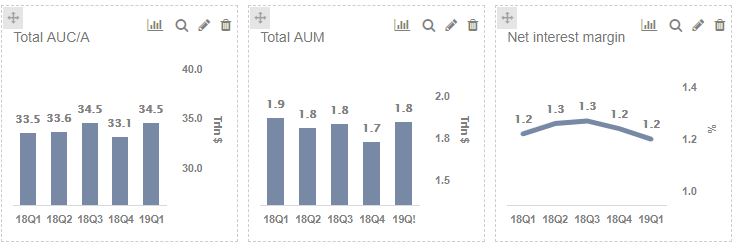

Meanwhile, the five year Mastercard share price forecast puts the stock as high as $585, an increase of 67% over the $350 level at the close on 22 March 2022. Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure.

As with any company, Mastercard faces several risk factors that could impact its financial performance. One of the most significant risks facing Mastercard is the potential for increased regulation of the payment processing industry. Mastercard is also vulnerable to changes in consumer behavior, such as a shift away from traditional payment methods toward mobile payments.

Recent News

This week is a busy one in particular, with every sector of the economy being represented. MasterCard came out with quarterly earnings of $2.80 per share, beating the Zacks Consensus Estimate of $2.71 per share. Mastercard will expand its cryptocurrency payment card programme by seeking more partnerships with crypto firms, the company’s head of crypto and blockchain said, even as the sector comes under closer… WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

Intra-Europe volume was 98% of its 2019 level (accelerating from 83% in Q3). Mastercard has been rated by analysts from houses such as Mizuho, Morgan Stanley, Raymond James, UBS Group, and Wedbush recently. “UK regulators are taking a long look at the fees charged by both Visa and Mastercard and EU regulators have already made plenty of noise about the lack of competition in the sector,” she said. She acknowledged Mastercard is “cautiously upbeat” about the outlook, however, and believes the company could be in a position to benefit over the coming months.

Analyst Ratings

Upgrade to MarketBeat All Access to add more stocks to your watchlist. One share of MA stock can currently be purchased for approximately $380.03. Sign-up to receive the latest news and ratings for Mastercard and its competitors with MarketBeat’s FREE daily newsletter. Mastercard has a solid commitment to corporate social responsibility and sustainability. The company has set ambitious goals to reduce its carbon footprint, increase financial inclusion and promote gender equality. Mastercard is also actively involved in philanthropic efforts, including the Mastercard Foundation, which focuses on advancing financial inclusion in Africa.

For the next year, analysts predict that EBITDA will reach $16.03B – an increase of 45.79%. Over the next eight years, experts believe that Mastercard’s EBITDA will grow at a rate of 113.06%. Real-time analyst ratings, insider transactions, earnings data, and more. The company’s average rating score is 2.82, and is based on 19 buy ratings, 2 hold ratings, and 1 sell rating.

“The potential cost of living crisis that could force consumers to back away from purchases in order to shore up their household finances,” she told Capital.com. Shares rose 22% to $395.65 by the end of April 2021 before falling to $306.28 by 1 December 2021. Mastercard stock had risen 15% over the past year from $323.26 to $372.14 as of the close of trading on 14 January 2022. After the companysuspended its operations in Russia the already bearish trend worsened dropping to a low of $306 on 8 March.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. COVID-19 was a significant short-term negative for Mastercard, with travel restrictions disrupting high-margin cross-border volumes, but a long-term positive, accelerating the shift to electronic payments.

- “Our performance was driven by the execution of our strategy, healthy domestic spending and solid growth in cross-border spending, which has recently returned to pre-pandemic levels,” he said.

- With shares at $382.51, for our standard 2024 year-end exit, we expect an exit price of $678 and a total return of 80% (16.4% annualized).

- Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents.

- 84% of retail investor accounts lose money when trading CFDs with this provider.

- The company has benefitted from the increasing shift towards digital payments – and this is expected to increase further due to the enthusiasm for online shopping.

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. It facilitates the processing of payment transactions, including authorization, clearing, and settlement, as well as delivers other payment-related products and services. According to the algorithmic forecasting of Wallet Investor as of 23 March, the stock might be a “good long-term investment” and could rise to $394 over the next 12 months.

This puts investment management what is it in the top 10% of approval ratings compared to other CEOs of publicly-traded companies. In the past three months, Mastercard insiders have sold more of their company’s stock than they have bought. Specifically, they have bought $0.00 in company stock and sold $226,379,020.00 in company stock.

Must-Buy Fintech Growth Stocks After the Fed “Bailouts”

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. CFDs are leveraged products, which means that you only need to deposit a percentage of the full value of the CFD trade in order to open a position. But with traditional trading, you buy the assets for the full amount.

Will Visa or Mastercard Have a Better 2023? – The Motley Fool

Will Visa or Mastercard Have a Better 2023?.

Posted: Thu, 15 Dec 2022 08:00:00 GMT [source]

This represents a $2.28 annualized https://1investing.in/ and a dividend yield of 0.60%. The ex-dividend date of this dividend is Wednesday, April 5th. The company is scheduled to release its next quarterly earnings announcement on Thursday, July 27th 2023.

Mastercard launches Web3 user verification solution to curb bad actors

Many of those behind the upbeat Mastercard stock price forecasts are relieved by the recovery in cross-border revenues. But based on the predictions being made by analysts, it seems that the risk to MA’s share price is limited. According to CNN Business, the low-end forecast for the next 12 months still anticipates that Mastercard’s stock will rise to $360.

Therefore, in addition to civil interaction, we expect commenters to offer their opinions succinctly and thoughtfully, but not so repeatedly that others are annoyed or offended. If we receive complaints about individuals who take over a thread or forum, we reserve the right to ban them from the site, without recourse. In addition, any of the above-mentioned violations may result in suspension of your account. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. To get in touch, use the website or Twitter account on our profile, as comments and messages on this site are no longer checked regularly.

28 people have added Mastercard to their MarketBeat watchlist in the last 30 days. This payout ratio is at a healthy, sustainable level, below 75%. Is a US-based licensed platform that provides crypto exchange services for US residents.

Mastercard’s (NYSE:MA) five-year total shareholder returns outpace the underlying earnings growth – Yahoo Finance

Mastercard’s (NYSE:MA) five-year total shareholder returns outpace the underlying earnings growth.

Posted: Wed, 22 Feb 2023 08:00:00 GMT [source]

Articles published under our name on Seeking Alpha were personal opinions, based on information believed to be correct at the time of writing, but not updated. With shares at $382.51, we expect shares to double to $790 in five years, including a total return of 80% (16.4% annualized) by 2024 year-end. We believe Mastercard’s (and Visa’s) strong network effects will ensure they remain an integral part of the payments ecosystem. Volume growth continued in January 1-21, with total volume at 49% higher than in 2019 and Cross-Border ex. With shares at $382.51, we expect shares to double to $790 in 5 years, including a total return of 80% (16.4% annualized) by 2024 year-end. The material provided on this website is for information purposes only and should not be understood as an investment advice.

MarketWatch

In the last two years, Mastercard’s EBIT has grown, moving from $9.67B to $10.27B – an increase of 6.22%. In the next year, analysts predict that EBIT will jump to $15.20B – up 48.07% from the current level. Looking ahead to eight years, experts forecast that EBIT will grow by 113.46%. This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 . This is a lower news sentiment than the 0.57 average news sentiment score of Business Services companies. Of course, analysts frequently get things wrong, so it’s important to do your own research before investing.

Is a global cryptocurrency exchange platform that currently does not operate in the US, still you are welcome to browse and find out more. The material provided on this website is for information purposes only and should not be regarded as investment research or investment advice. Any opinion that may be provided on this page is a subjective point of view of the author and does not constitute a recommendation by Currency Com or its partners. We do not make any endorsements or warranty on the accuracy or completeness of the information that is provided on this page.

Mastercard Stock To Top The Consensus In Q2? – Forbes

Mastercard Stock To Top The Consensus In Q2?.

Posted: Tue, 26 Jul 2022 07:00:00 GMT [source]

Get MarketBeat All Access Free for 30 DaysJoin thousands of other investors who make better investing decisions with our premium tools. Access advanced stock screeners, portfolio monitoring tools, proprietary research reports, and more. Is a global cryptocurrency exchange platform that allows you to trade crypto and other assets. Is a global cryptocurrency exchange platform that currently does not operate in Europe, UK and Australia, still you are welcome to browse and find out more.

- Q4 results showed that earnings have more than recovered and are on track to meet mid-term targets.

- 22 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for Mastercard in the last twelve months.

- During the year Mastercard said it spent $5.9bn buying 16.5 million shares.

- Over the next eight years, experts believe that Mastercard’s EBITDA will grow at a rate of 113.06%.

There are currently 1 sell rating, 2 hold ratings and 19 buy ratings for the stock. The consensus among Wall Street analysts is that investors should “buy” MA shares. Mastercard stock forecasts have hinged upon the increasing adoption of contactless payments. While this technology is the norm across large swathes of Europe, the US is behind the curve. There are three billion Mastercard and Maestro-branded cards in use worldwide. Contactless transactions represented half of in-person purchases globally in the fourth quarter.

Remember, shares go down as well as up, and it’s unwise to invest more than you can afford to lose. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. At 2026 year-end, approximately five years from today, applying the same 42.0x P/E to 2026 forecast EPS of $18.82 would give a share price of $790, more than double the level today. Whether MA is a suitable investment depends on your own investment objectives – and the opinion you form based on your own research. Remember, it’s important to reach your own conclusion about the company’s prospects and likelihood of achieving analysts’ targets. You should never invest funds that you cannot afford to lose.